Mis-hires rarely happen because candidates lack skills. They happen because teams underestimate how people behave under pressure.

In fintech environments, delivery stress, regulatory scrutiny, and fast funding cycles expose behaviour quickly. When hiring decisions rely on CVs and interviews alone, misalignment slips through unnoticed until it becomes expensive.

Behavioural benchmarking addresses this gap. It shifts hiring from opinion-led decisions to evidence-based alignment, reducing mis-hires where the cost is highest.

Why Skills-Based Hiring Fails in Fintech

Technical competence is expected at senior level. It is not the differentiator.

Fintech teams often hire engineers and leaders who look perfect on paper but struggle once exposed to real operating conditions. Decision-making slows. Ownership blurs. Conflict increases under delivery pressure.

These issues rarely appear in interviews because traditional hiring does not measure how people actually behave in complex environments. Behavioural benchmarking fills that blind spot.

What Behavioural Benchmarking Really Measures

Behavioural benchmarking analyses how high performers succeed inside your specific business.

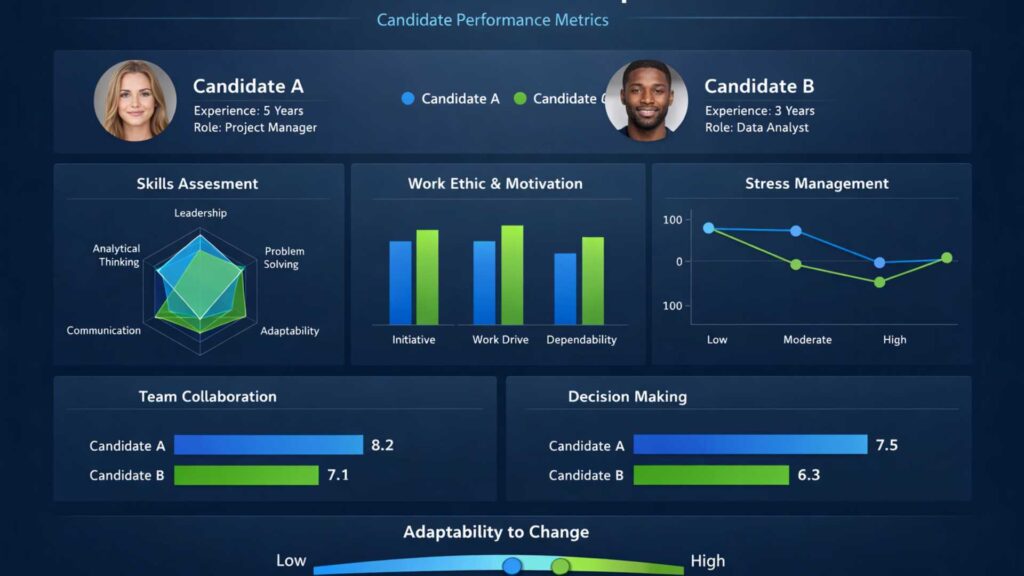

Rather than generic competencies, it focuses on:

- Decision-making patterns under pressure

- Communication style across technical and non-technical teams

- Risk tolerance in regulated environments

- Leadership behaviour during delivery stress

This creates a behavioural blueprint based on reality, not assumption. Candidates are assessed against what success looks like in your fintech, not an idealised version of the role.

Free Guide: Bad Hire. Big Cost – How to Avoid Hiring Mistakes

How This Reduces Mis-Hires at Senior Level

Senior mis-hires are rarely immediate failures. They erode value quietly.

Behavioural mismatch leads to slow decision-making, team friction, and increased attrition around the hire. By the time problems surface, replacement costs are already high.

Behavioural benchmarking identifies risk early. It highlights where a candidate may struggle before the hire is made, allowing teams to make informed decisions or adjust role scope accordingly.

This protects retention and stabilises delivery during scale.

The Role of Psychometric Assessment

Psychometric assessment adds another layer of clarity.

While behavioural benchmarking defines what success looks like, psychometrics evaluate whether a candidate is wired to deliver it consistently. This combination reduces reliance on gut feel, particularly when hiring under time pressure.

For fintech leaders who have experienced costly mis-hires, this structure restores confidence in the hiring process.

Good Read: Why November Is the Ideal Time to Build Your FinTech Talent Pipeline

Why December and Q1 Hiring Demands Structure

Hiring pressure peaks in Q1. Timelines compress and shortcuts appear.

Behavioural benchmarking protects decision quality when speed increases. It allows fintech teams to move faster without increasing risk, particularly for leadership and senior engineering roles.

This is why structured assessment consistently outperforms reactive hiring in high-growth environments.

Fewer Mis-Hires Mean Stronger Retention

Retention is rarely about perks or salary alone. It is about fit.

When behaviour aligns with team expectations, hires embed faster, lead more effectively, and stay longer. Behavioural benchmarking directly supports long-term retention by reducing silent misalignment.

For fintech firms preparing funding rounds or scale phases, this stability is critical.

Reduce Mis-Hire Risk Before It Reaches Delivery

If mis-hires have already slowed delivery or damaged team morale, the cost is higher than it appears.

Rec2Tech helps fintech teams reduce mis-hires through retained search, behavioural benchmarking, and psychometric assessment built around real performance data.

Reduce hiring risk before it reaches your roadmap. Book a structured hiring consultation today.