Leadership hiring rarely aligns neatly with funding timelines. Capital arrives fast, while leadership transitions move slowly.

For fintech firms planning funding rounds in 2026, leadership strategy must begin far earlier than most expect. CTOs, VPs of Engineering, and senior technology leaders often require months, not weeks, to secure.

December and early planning periods provide the space to build this strategy properly.

Why Leadership Hiring Cannot Be Rushed

Hiring for leadership roles cannot be rushed due to the profound and lasting impact these individuals have on an organization’s performance, culture, and strategic direction.

Key Reasons Why Leadership Hiring Requires Careful Consideration:

- Long-term Impact and Instability: Leaders influence an organization’s performance, engagement, culture, hiring standards, and technical direction for years to come. Rushed decisions can introduce instability, a negative culture, or a failure of character that persists and causes significant damage long after the initial hire.

- Strategic Alignment and Vision: Effective leaders are crucial for ensuring employees are focused on the organization’s vision and are committed to its goals. A hurried process risks misalignment with the company’s core mission and values, which can lead to confusion, demotivation, and an inability to adapt to change.

- Talent Attraction and Retention: Bad leaders are corrosive to a company culture and can drive out good employees. A thorough, unhurried hiring process helps identify leaders with integrity, accountability, and the ability to inspire and motivate teams, which is essential for attracting and retaining top talent in a competitive market.

- Complex Process and High Stakes: Securing the right executive involves strategy, insight, and cultural fit challenges that cannot be evaluated quickly. It is not merely about speed but about finding a candidate who brings fresh perspectives and can handle the complexity of modern business environments.

- Logistical Challenges: Practical issues such as long notice periods make timing critical. Waiting until funding is secured often means the essential leadership role remains vacant through the most demanding growth phases, creating operational gaps at a critical time.

- Avoiding “Comfort Hires”: A rushed process may lead to “comfort hiring,” where organizations choose familiar candidates rather than those who bring the necessary fresh perspectives and skills to drive innovation and growth.

Aligning Leadership Strategy With Funding Reality

Funding increases expectations instantly.

Investors expect delivery acceleration, platform resilience, and leadership maturity. If leadership hiring begins after funding closes, pressure transfers to existing teams.

Early planning allows fintech firms to:

- Define leadership gaps before scale begins

- Map start dates realistically

- Engage leaders discreetly ahead of market competition

This alignment protects delivery and investor confidence.

To prepare for the demanding growth phases of 2026, fintech firms must shift from reactive to strategic leadership hiring. Expanding these critical areas ensures long-term stability and competitive advantage:

Why Passive Leaders Engage Early

Senior leaders rarely respond to urgent “we need to hire now” messages. They are most receptive when conversations are strategic and framed as long-term opportunities.

- Strategic Windows: Planning windows (like December or early Q1) allow fintech teams to discuss vision and growth without the pressure of an immediate vacancy.

- Opportunity over Reaction: Early engagement positions the role as a chance to shape the company’s future rather than a desperate reaction to a funding injection, which is more attractive to high-caliber, currently employed executives.

Behavioural Alignment at Leadership Level

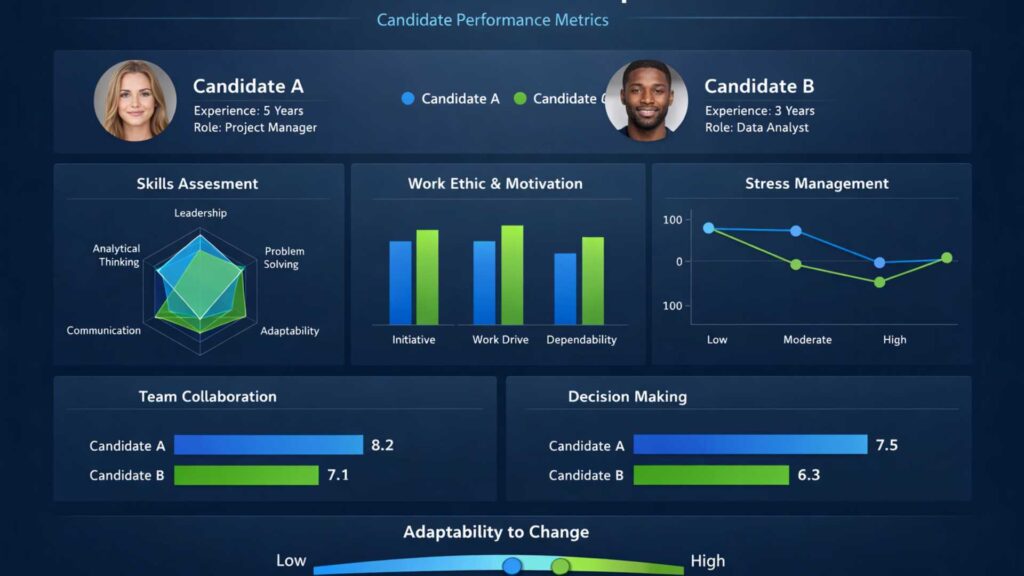

In the 2026 landscape, technical skill is secondary to human-centric capabilities like emotional intelligence and ethical judgment. Misalignment at this level is incredibly costly, leading to role conflict and employee burnout.

- Decision-Making Benchmarking: Behavioural assessments ensure a leader’s decision-making style—particularly under the pressure of scaling—aligns with the firm’s core values.

- Consistency Under Pressure: Psychometric assessments provide objective confidence that a leader’s behavior will remain stable during volatile funding cycles.

Retained Search Protects Confidentiality

For fintech firms, maintaining discretion around funding rounds and leadership changes is essential to protect internal morale and external brand reputation.

- Quiet Engagement: Retained search firms act as an exclusive partner, mapping the market and approaching top-tier talent without publicly broadcasting the role.

- Brand Protection: This approach prevents multiple agencies from contacting the same small pool of candidates, which can appear unprofessional and signal instability to competitors.

Planning Now Reduces 2026 Risk

Strategic workforce planning for 2026 requires identifying talent gaps well before they become critical.

- Controlled Process: Early strategy transforms hiring into a controlled process where start dates align with specific growth phases, avoiding the lag that occurs when hiring starts only after capital arrives.

- Confidence in Growth: Fintechs that plan early enter funding rounds with a solid leadership pipeline, signaling to investors that they are prepared to scale immediately and effectively.

Secure Leadership Before Growth Accelerates

If 2026 growth depends on strong technical leadership, planning must start now.

Rec2Tech partners with fintech teams to design leadership hiring strategies through retained search, behavioural benchmarking, and psychometric assessment.

Build your leadership pipeline before funding pressure hits. Speak to our team and secure future-ready leaders today.

Book a strategy call with us.