FinTech Global Talent: GCC and Europe Recruitment Insights

Fintech growth depends on talent. Without the right engineers, architects, product specialists, or security leaders, innovation slows. Markets move faster than hiring cycles, leaving teams short-handed while competitors release features at speed. This is why more fintech firms are turning to global talent pools rather than relying on local hiring alone. Two regions in particular have become prime sources of specialist talent for fintech: the Gulf Cooperation Council and Europe. Each region offers unique strengths, cultural approaches to engineering, distinct academic pipelines, and different motivations for mobility. When approached with a thoughtful global fintech talent strategy, these regions can fill critical capability gaps and reduce the pressure placed on overstretched local markets. Why FinTech Is Building Global Talent Pipelines The shortage of senior technical talent affects nearly every fintech hub. London, Amsterdam, Dublin, Dubai, Riyadh, Berlin, and Paris face similar pressures. Products are expanding faster than engineering teams can grow, and retention challenges limit momentum. As a result, global hiring has become less of a trend and more of a necessity. Three realities are driving this shift. Local Markets Cannot Meet the Depth or Speed Required Even well-established hubs cannot consistently supply senior engineers with experience in payments, blockchain, regtech, fraud prevention, security hardening, or large-scale architecture. Demand rises faster than local pipelines produce specialised talent. Growth Timelines Are Compressing Pressure from investors and competition means fintech companies cannot wait six to twelve months for a shortlist. Global searches reduce the bottleneck by widening the pool to thousands of candidates rather than hundreds. Distributed Talent Is Now The Norm Remote and hybrid adoption has unlocked cross-border hiring. Candidates are more open to relocation or remote-first roles, and companies are more open to global teams as long as delivery standards remain high. These trends are why GCC and Europe have become strategic regions for fintech recruitment. The GCC: A Rapidly Developing Hub for Engineering and Product Talent The GCC has undergone one of the fastest digital growth periods in the last decade. Regions such as the United Arab Emirates, Saudi Arabia, and Qatar are investing heavily in digital infrastructure, financial technology, cybersecurity, and talent development. This investment has produced a consistent stream of engineers and product leaders with experience in high-scale financial systems. What Makes GCC Talent Attractive to Fintech Firms Strong exposure to digital-first financial environments: The GCC’s rapid digital banking adoption means local engineers often work with modern stacks, cloud-native builds, and security-heavy environments. Multicultural engineering teams: GCC talent pools include professionals from across India, Pakistan, Egypt, Jordan, Lebanon, South Africa, Europe, and Southeast Asia. These candidates tend to be highly adaptable and comfortable working in diverse teams. High motivation for international mobility: Many GCC-based engineers and product specialists are open to relocation or remote work with European firms, often seeking long-term career stability and exposure to wider fintech markets. Availability of niche skill sets: Areas such as payments compliance, digital identity, and cybersecurity are particularly strong in this region due to government-scale digital programmes. Types of Roles Commonly Sourced From GCC Markets The GCC’s mix of scale, diversity, and technical depth makes it an efficient source of senior capability for fintech firms that need to grow quickly without compromising quality. Good Read: Europe vs GCC: Where Fintechs Are Scaling Fastest in 2025 Europe: A Deep and Mature Tech Talent Reservoir Europe has long been a dominant contributor to global fintech talent. Cities such as Berlin, Warsaw, Lisbon, Bucharest, Barcelona, Prague, Krakow, Vilnius, and Tallinn have produced some of the strongest engineering and product communities worldwide. They combine technical depth with a culture of precision and long-term career development. Why European Talent Is Highly Valued Strong Academic Foundations: Central and Eastern Europe produce highly skilled engineers through rigorous academic programmes in mathematics, engineering, and computer science. Experience in Regulated Markets: Many European engineers have experience working within the structure of PSD2, GDPR, and various banking regulations. This experience is incredibly valuable to fintech scaling into compliance-heavy products. High Retention Behaviour: European engineering talent often values stability and craftsmanship, which leads to longer tenure and more predictable team performance. Willingness to Relocate or Work Remotely: Relocation within Europe is common. Engineers and product specialists are highly open to joining UK and GCC-based fintech firms when there is a clear growth path. Roles Frequently Hired From European Talent Pools Europe offers a mature, reliable, and scalable pipeline for companies needing long-term technical depth. How to Build a Global FinTech Talent Strategy That Works Access to talent is one part of the puzzle. The bigger challenge is designing a global hiring strategy that respects cultural differences, aligns with local expectations, and communicates clearly what success looks like. Below are the pillars that strengthen any global fintech talent strategy. 1. Build clarity around role expectations. Global candidates require clarity about relocation conditions, hybrid setups, product vision, and growth opportunities. A lack of clarity repels international talent faster than anything. 2. Use market-specific assessment strategies. Different regions require different evaluation styles.For example: A single assessment style for all markets reduces your reach. 3. Offer relocation or remote flexibility. Fintech firms that widen their working structure attract stronger talent. Flexibility also increases diversity in engineering and product teams. 4. Strengthen cultural integration. Cross-border hires stay longer when they feel included.This requires: Cultural integration is often the deciding factor in year-one retention. 5. Partner with recruiters who specialise in global fintech hiring. General recruitment does not translate well into cross-border strategies. Fintech roles require deep technical understanding, behavioural insight, and awareness of regional hiring differences. Without this, global hiring becomes unpredictable. Download Our Free Guide: Bad Hire. Big Cost – How To Avoid Hiring Mistakes How Rec2Tech Supports Global FinTech Hiring Across GCC and Europe Rec2Tech specialises in recruiting senior fintech talent across the UK, Europe, and the GCC. Our approach focuses on long-term retention, precise alignment, and a seamless candidate experience built for cross-border hiring. Here is how we strengthen global recruitment outcomes for fintech firms: Cross-market insight: We understand the engineering and product

Onboarding for Retention: How to Keep FinTech Hires Beyond Year One

Hiring someone great in fintech is only half the victory. Keeping them past year one is the real indicator of team strength. Early churn disrupts product velocity, drains leadership time, inflates costs, and shakes confidence inside teams that already operate under pressure. A strong onboarding experience prevents this spiral and gives new hires a foundation that feels stable enough to grow from. FinTech onboarding is not a ceremonial welcome. It is the first performance environment a hire enters. If the environment feels chaotic, incomplete, or ambiguous, they assume the company operates this way permanently. If it feels structured, supportive, and predictable, they commit faster. The first year becomes a launchpad rather than a test of survival. Onboarding gives new fintech hires their instruments. Without them, everything feels guesswork. Good Read: Retained Search vs Contingent Recruitment: Which Works Best for FinTech Why Retention Hinges on the First Year Year-one churn is expensive in every industry. In fintech, the cost compounds because the skills involved sit at the centre of product delivery. When a backend engineer leaves early, it delays a sprint and often increases risk in compliance-heavy features. When a product leader exits, the roadmap fractures. Typical impacts include: None of these are simple fixes. This is why onboarding is not an HR formality. It is risk prevention. What New FinTech Hires Actually Need Plenty of onboarding checklists look complete on paper. Very few match what a senior engineer or architect needs to perform well in a regulated, fast-moving environment. Here is what genuinely supports them in the first 90 days: 1. Clarity Not motivational clarity, but practical clarity such as: When hires can see the grand pattern, they settle quickly. 2. Context Fintech is full of nuance. Even simple features can be shaped by licensing rules, security requirements, or investor pressures. New hires must learn the technical and non-technical context behind decisions. If not, they build confidently in the wrong direction. 3. Access Tools, documentation, repos, people. Without friction. Without delay. Waiting three days for a permission level sounds minor but sets the tone for everything that follows. 4. Early wins The psychological effect is huge. An early win replaces doubt with momentum. Download Our Free Guide: Bad Hire. Big Cost – How to Avoid Hiring Mistakes Why Onboarding Fails More Often in FinTech Three patterns show up repeatedly: 1. “They’re senior, they’ll figure it out.” Seniority is not a substitute for structured onboarding. High performers want clarity more than anyone because clarity accelerates contribution. 2. No consistent touchpoints A single induction cannot guide someone through their first quarter. Without follow-ups, misalignment grows quietly until it becomes resignation. 3. Tribal knowledge everywhere If the only people who understand a system are the ones who built it, new hires start behind and stay behind. Documentation gaps are retention gaps. When these patterns stack, the hire begins to doubt their long-term future even if the work itself is exciting. Shape an Onboarding Experience That Acts Like a Retention Engine There is no single formula, but high-performing fintech teams share a few habits that consistently lead to better retention outcomes. Start Before Day One Prepare role expectations, behavioural insights, and success markers in advance. This removes ambiguity and helps managers guide early performance without guesswork. Use a 30–60–90 plan that feels like a roadmap, not a checklist Each stage has a purpose: The pacing matters more than the paperwork. Blend technical onboarding with cultural grounding A highly skilled engineer may still leave if they cannot understand how decisions move across the organisation. The cultural layer is as significant as the technical one. Make leaders visible A short welcome call with the CTO or VP Engineering sets a tone that retention matters and the hire is expected to succeed, not merely survive. Normalise questions When new hires feel safe asking questions, they integrate twice as fast. Silence is rarely a sign of comfort. It is usually the first stage of withdrawal. Support and Coaching: Where Retention Quietly Builds Retention does not live in the welcome pack. It lives in the weeks after. The hires who thrive long-term usually experience the following: A common scenario Rec2Tech sees: a hire looks strong on paper but becomes quiet by week six. No conflict. No obvious performance problem. Just subtle disengagement. In 80 percent of these cases, the root issue is one of three things: unclear expectations, lack of early feedback, or no trusted person to ask simple questions. Small problems, if ignored, become exit decisions. How Rec2Tech Strengthens Retention Through Onboarding Rec2Tech’s approach places retention at the centre of every hire. This is why clients experience stronger year-one stability and fewer repeat searches. Here is how the retention layer is built: 1. Alignment before day one We confirm mutual expectations between you and the hire so early missteps do not snowball into dissatisfaction. 2. Behavioural and technical blueprints These insights help managers understand how the hire communicates, learns, problem-solves, and responds under pressure. 3. Support across the first 90 days We provide integration touchpoints that surface concerns early while helping managers interpret small behavioural cues that indicate a hire needs support. 4. Twelve months of post-hire retention care A long-term structure ensures the hire continues to feel anchored, guided, and valued as responsibilities grow. This is where clients see the biggest shift. Retention stops being reactive. It becomes a measurable, ongoing discipline. The Companies That Keep Talent Are the Ones That Start Strong Fintech teams succeed when onboarding feels like a bridge rather than an obstacle. The strongest foundations come from clarity, context, consistent support, and leadership presence. A hire who understands the environment quickly and feels supported throughout their first year is far more likely to stay through future product cycles, funding rounds, and scale-up challenges. Stability follows. High-performing teams know this. They do not treat onboarding as an event. They treat it as momentum creation. Strengthen year-one retention with onboarding that gives fintech hires clarity, confidence, and long-term direction. Rec2Tech supports every stage from

Building a FinTech Employer Brand That Attracts Niche Tech Talent

FinTech companies operate in one of the most competitive hiring environments. Skilled engineers receive multiple offers, often before a role is even advertised. A strong employer brand helps your company stand out long before an interview takes place. Top talent pays attention to more than salaries. They want purpose, clarity, trust, and work that challenges them. A clear employer brand makes these qualities visible and helps you attract candidates who value long-term growth. Why Employer Branding Matters More in FinTech FinTech sits at the intersection of regulation and rapid innovation. Engineers look for workplaces that support experimentation but still maintain high security and reliability. A strong employer brand builds trust in this balance. Many fintechs assume higher pay is enough. Yet research consistently shows engineering talent responds more to purpose and strong leadership than perks. A good employer brand works like a lighthouse that stays bright during uncertainty, guiding the right people toward you even when the market feels crowded. A defined brand also reduces friction. Candidates walk into interviews with stronger understanding, fewer doubts, and more confidence in your direction. Showcase What Makes Your FinTech Different Before candidates review your tech stack, they assess your story. This includes: Most fintechs say the same things. You stand out by showing real examples of how your teams solve problems, approach architecture decisions, or handle rapid product changes. Specifics build credibility. Generalities weaken it. Engineers want to see where the company is going, not just where it is today. When you share the roadmap, they can picture their place within it. Good Read: Build the Right Team for your Next FinTech Funding Round Highlight Engineering Culture With Substance Real engineering culture lives in structure, ownership, and communication. It is seen in how your team handles code reviews, documents systems, shares knowledge, and moves from planning to execution. Your employer brand becomes stronger when you show: Share tangible moments. It could be a technical breakout, a refactor that improved reliability, or a process that helped reduce bugs. This level of detail attracts engineers who look for maturity rather than noise. Download Our Free Guide: Bad Hire. Big Cost – How To Avoid Hiring Mistakes Use Real Employee Stories Instead of Polished Claims Candidates trust the experiences of real engineers more than polished statements. Highlight short stories from your team: These narratives help candidates imagine themselves inside your organisation. Choose different roles so the picture feels layered, not staged. Backend, security, data, mobile, DevOps, and product should each have a presence. Authenticity always outperforms slogans. Create a Clear Value Proposition for Niche Engineers A strong employer brand includes a value proposition that explains why someone should join you instead of a global bank or a remote-first unicorn. Engineers want clarity in three areas: Avoid broad promises. Instead, spell out what progression looks like, how feedback works, and how engineers influence product direction. When candidates see what their future could look like, commitment increases. Connect Your Brand to Real Customer Impact FinTech attracts people who want their work to matter. Whether you improve cross-border payments, identity verification, or compliance automation, your employer brand should make this impact visible. Engineers want to know the “why” behind the code. When they understand how their work affects customers, they feel deeper ownership and long-term alignment. This sense of impact often outweighs higher salaries elsewhere. Share this openly across your website, social channels, and hiring materials. Consistency strengthens trust. Deliver a Candidate Experience That Matches Your Brand The quickest way to weaken an employer brand is through a confusing hiring process. Your interviews should reflect the professionalism and clarity you want your company to be known for. FinTech candidates expect: This does more than improve acceptance rates. It signals operational strength, which matters for engineers choosing a scale-up over a larger competitor. How Rec2Tech Supports FinTech Employer Branding Rec2Tech helps fintech startups and scale-ups build employer brands that attract senior engineers, product leaders, and niche technical specialists. Our advisory approach blends behavioural profiling, market intelligence, and technical evaluation to shape messages that resonate with the right audience. We work with high-growth fintechs across the UK, Europe, and the GCC that need deeper alignment, stronger positioning, and hiring strategies built for long-term stability. Make Your Employer Brand a Magnet for Specialist Talent A strong fintech employer brand does more than attract applicants. It draws in the right engineers who stay longer, perform better, and strengthen your product at every stage. When your story, culture, and engineering standards are clear, you stand out even in a crowded hiring landscape. Rec2Tech helps fintechs build employer brands that connect with specialist engineering talent. Book a call to strengthen your hiring strategy and sharpen your message.

Retained Search vs Contingent Recruitment: Which Works Best for FinTech

FinTech scale-ups cannot afford drawn-out hiring cycles or shallow talent pools. A single mis-hire delays product delivery, slows revenue targets, and adds unexpected salary burn. Choosing between retained search and contingent recruitment shapes how quickly your company secures the right engineers, product leaders, and technical specialists. Both models have a place, yet their impact differs sharply at scale-up level. If your roadmap depends on stable senior hires who stay through funding milestones, understanding the strengths and limits of each approach matters more than ever. What Is Retained Search in FinTech? Retained search is a structured, partnership-led hiring model where your recruitment partner works exclusively on your brief. The project begins with alignment sessions, behavioural benchmarks, role definition, and market intelligence. This approach gives you methodical outreach, deeper evaluation, and a shortlist built on fit rather than speed. Retained search suits fintechs with regulated environments, complex tech stacks, or roles that require trust and confidentiality. You receive priority access to networks and passive candidates who rarely respond to open adverts. Think of retained search like commissioning a specialist architect instead of browsing generic floor plans; you gain a design shaped precisely for your growth stage. What Is Contingent Recruitment? Contingent recruitment works on a “no placement, no fee” model. Multiple agencies may compete for the same role, and the initial screening aims to deliver candidates quickly. It is often used for mid-level roles or situations where speed is the main priority. This model offers broad reach, yet it lacks the depth many fintech roles require. Because agencies compete, they focus on volume rather than full evaluation. That can work for high-turnover positions, but it becomes risky for senior or specialist technical posts. Contingent recruitment is similar to browsing a busy marketplace; you see plenty of options, but the quality varies and the selection may not align with your long-term goals. Key Differences Between Retained and Contingent Recruitment 1. Speed vs Precision Retained search moves with deliberate focus. Your partner handles technical benchmarking, behavioural assessments, and structured shortlisting. This eliminates false starts and repeated rounds of screening. Contingent recruitment feels faster at the surface because multiple CVs arrive quickly. However, the speed hides inefficiencies. You often review candidates who lack cultural fit or depth in specific fintech frameworks such as cloud-native security, transaction monitoring, or scalable architecture. 2. Access to Passive Talent Retained partners have access to talent you cannot reach through job boards or general searches. Most senior engineers and fintech leaders are passive candidates who respond to discreet, tailored outreach. Contingent recruiters rely more on active applicants. This narrows your pool, especially when competing with global fintech hubs across the UK, EU, and GCC. 3. Candidate Quality and Assessment Retained search includes structured assessments, psychometrics, and cultural-fit evaluation. Every candidate is benchmarked against your growth strategy, stack maturity, and funding trajectory. Contingent recruitment rarely includes behavioural profiling or long-term retention checks. The focus is on fast submission rather than deep analysis. 4. Commitment and Accountability Retained search creates mutual accountability. Your recruiter commits resources and time, and you commit to a partnership. Contingent recruitment spreads responsibility across multiple agencies. No one owns the process end-to-end, and coordination becomes fragmented. 5. Cost Efficiency Over Time Retained search may feel like a larger upfront investment. However, it lowers long-term hiring costs through higher retention and fewer mis-hires. Contingent recruitment appears cheaper, yet mis-hires, early attrition, and repeated searches lead to higher hidden costs. Download Our Free Guide: Bad Hire. Big Cost – How to Avoid Hiring Mistakes Which Model Works Best for FinTech Scale-ups? FinTech scale-ups face unique pressures. You operate in high-stakes, high-compliance environments. Your product depends on engineering stability, secure code, and technical leadership that can adapt to rapid growth. Retained search aligns with these demands. It gives you access to deeper networks, structured evaluation, and candidates who match the behavioural profile of long-term, high-impact hires. This is why retained models dominate senior hiring across sectors that require precision engineering and regulatory confidence. Contingent recruitment still has a place. For roles that need fast coverage or temporary support, it offers flexibility. However, for senior engineers, product leads, CTO-level hires, and roles tied to funding milestones, retained search consistently delivers stronger outcomes. Good Read: From Offer to Onboarding: Why Most Fintech Hires Fail in Month One Why Retained Search Performs Better in Regulated FinTech FinTech hiring requires trust. You are often dealing with cryptographic frameworks, sensitive data architecture, cloud compliance, and technical teams operating under pressure. Retained search addresses these layers through structured evaluation. This model also supports the scale-up journey. As your engineering team grows from 10 to 50 to 150, alignment becomes more important than speed. A mis-hire early in Series A or B creates technical debt that compounds over time. Retained partners filter out candidates who may have strong technical skills but cannot thrive in fast-moving, investor-driven environments. Research from senior hiring markets shows that retained search consistently fills complex roles faster because the process removes noise rather than adding it. You gain clarity instead of volume, similar to using noise-cancelling headphones that allow only the relevant information through. How Rec2Tech Helps FinTech Scale-ups Choose the Right Model Rec2Tech supports fintechs through retained search, contract recruitment, and talent advisory. Our approach is shaped by data-driven benchmarking, behavioural profiling, and psychometric tools that identify genuine alignment. We work exclusively with fintech companies that value precision, depth, and long-term stability. This aligns with your position as a strategic partner for scale-ups operating across the UK, Europe, and GCC. Whether you need a CTO for a Series A raise, a senior engineer to unblock product delivery, or contract specialists for a high-pressure sprint, we guide you toward the model that fits your growth stage. Choose the Model That Strengthens Long-Term Hiring Retained search vs contingent recruitment becomes a clearer choice once you consider the risk, cost, and depth required for fintech hiring. If your priority is stability, precision, and access to passive senior talent, retained search gives you the strongest

Build the Right Team for Your Next FinTech Funding Round

Scaling a fintech business is rarely a straight line. Each funding round shifts your priorities, expands expectations, and reshapes the team you need to deliver the next phase of growth. Yet many companies still hire reactively, filling roles based on short-term demand instead of aligning recruitment with their roadmap, investor expectations, and product trajectory. A strong fintech funding round hiring strategy avoids this cycle. It creates clarity on who to hire, when to hire, and how to secure people who can thrive under new pressures that often increase immediately after capital arrives. Rec2Tech’s data-driven approach shows that scale-ups who plan their talent needs before each round move faster, avoid common hiring mistakes, and build teams that stay beyond the first year. Why Funding Rounds Reshape Your Hiring Needs Each stage of investment pushes the company into a new phase of complexity. A team that works well at seed level will not sustain Series A, and a Series A structure will struggle under Series B demands. Every Round Adds New Goals That Require New Skill Sets Investors want progress that can be measured, such as customer growth, market expansion, regulatory alignment, or product improvements. To support those goals, a company must refine its talent mix. A seed-stage team might rely on adaptable generalists. By Series A, you need specialists who can deepen product stability, improve security, or scale infrastructure. By Series B, leadership maturity becomes essential. It is similar to switching from a compact toolkit to a full workshop. Early tools get you moving, but precision equipment becomes essential once the structure grows. Roles Become More Defined as the Business Scales Seed conversations often revolve around building the minimum viable product. At Series A, it becomes about stability and reliability. At Series B, the focus shifts to scale and customer trust. Your talent priorities shift across these phases: Planning ahead ensures that hiring supports the round rather than reacting to it. Good Read: Q4 Headcount Planning for Fintech Funding Rounds Building the Foundation for Stability Most fintechs at seed level focus on proving market viability. Funding gives breathing room, but it also creates expectations. Technical Stability Becomes the First Priority Series A investors want product reliability. That means moving from “build fast” to “build safely”. Key areas often require immediate attention: This is where the first wave of highly specialised engineers enters the picture. Psychometric Insights Help Spot Those Who Can Transition Through Growth A rapid shift in expectations can be challenging for early employees. Some thrive in structure; others prefer the energetic chaos of early-stage development. Rec2Tech uses behavioural data to identify candidates who adjust well to changing priorities. This prevents early turnover, which often occurs within the first six months post-Series A. Scaling Operations and Strengthening Compliance Series B capital usually focuses on speeding up customer acquisition, expanding the product, and improving operational resilience. Leadership Becomes Essential, Not Optional Technical teams at this stage require guidance, delegation, and clear roadmaps. Without experienced leaders, development may slow as the product becomes more complex. Fintech scale-ups often need: A defined hierarchy supports predictable progress and reduces internal friction. Operational Talent Must Support Growth Pace Customer support, onboarding teams, fraud analysts, and product specialists become vital. Hiring them early prevents delays once user numbers start climbing. This is where Rec2Tech encourages companies to build multi-role pipelines instead of individual requisitions. A structured pipeline reduces the risk of rushed decisions once user growth accelerates. Download Our Free Guide: Bad Hire. Big Cost – How To Avoid Hiring Mistakes Preparing for Larger Markets and Heavier Regulation With each round, regulation becomes more central. Markets tighten, expectations rise, and investor scrutiny increases. Compliance and Security Roles Take Priority Whether entering new markets or securing enterprise partnerships, fintechs require stronger governance. Recruiters often see delays when companies hire too late in this area. Roles often needed include: These roles influence investor confidence, making early planning essential. Product and Tech Teams Require Deep Specialists Product complexity evolves with scale. Payment systems expand, integrations multiply, and performance demands rise. Investing early in: helps companies maintain momentum during high-pressure growth phases. Why a Hiring Strategy Must Align with Funding Milestones Each investment round unlocks new responsibilities and requires new talent rhythms. Aligning hiring with funding milestones prevents gaps that slow delivery. A Clear Roadmap Reduces Hiring Mistakes Reactive hiring often leads to mismatched expectations, unclear responsibilities, and a higher risk of early turnover. When hiring aligns with future needs rather than current pain points, the team grows with purpose. This approach creates smoother transitions, even in high-pressure periods. Data Guides Decisions Before Pressure Builds Rec2Tech uses behavioural benchmarking, psychometrics, and retention data to predict how candidates will perform once growth accelerates. This ensures your next wave of hires matches the environment that will exist after the round closes rather than the environment from six months ago. Faster Hiring Means Faster Scaling When roles are defined early, interviews begin sooner. Companies with strong pipelines often make offers within the first few weeks after funding, while others may still be drafting job descriptions. This is a significant competitive advantage in fintech, where skill shortages remain a challenge. How Rec2Tech Helps Scale-ups Prepare for Each Funding Stage Rec2Tech’s data-driven approach supports scale-ups as they transition between milestones. Psychometric insights highlight how candidates think, communicate, and respond to change. This helps build teams who grow through the pressure of scaling, which is crucial during post-funding expansions. Rec2Tech maps technical depth, communication style, and problem-solving traits to create data-backed shortlists. This leads to healthier team dynamics and a stronger long-term fit. Clear hiring plans show investors how resources will be used. A structured roadmap strengthens trust and demonstrates that the company understands what is needed to scale. By planning talent around funding cycles, fintechs move faster and with more certainty. Why Forward Talent Planning Shapes Stronger Funding Outcomes Scaling is more predictable when hiring supports the next growth step rather than reacting to current pressure. Investors notice when a company is prepared, and

Retention by Design: Behavioural Signals That Predict a 12-Month Fit

High-growth fintechs live and die by the strength of their teams. The right hire powers momentum, keeps projects moving, and ensures investors see consistent delivery. The wrong hire, on the other hand, creates a costly bottleneck. Salary, onboarding, and lost time quickly add up, and when a candidate leaves within months, the disruption lingers far longer than their tenure. Retention is not an afterthought. For fintech executives under pressure to scale engineering teams, it is the North Star. The challenge is spotting who will stay the course before an offer is even made. Rec2Tech approaches this problem through behavioural benchmarking, ensuring cultural and technical alignment is built into the hiring process from day one. Why Retention Defines Fintech Growth Every founder and chief technology officer (CTO) in fintech knows the pain of turnover. Demand for developers, architects, and cyber leaders consistently outpaces supply. When an engineer leaves after six months, the void disrupts sprint cycles, distracts senior leaders, and risks regulatory deadlines. Retention does more than cut replacement costs. It provides stability during funding rounds, allows product roadmaps to stay on track, and helps teams avoid the fatigue of constant backfilling. For scaling firms of 10 to 500 employees, that stability is what transforms a good product into a market contender. Behavioural Cues as Early Indicators Curriculum vitae and technical assessments can prove what a candidate has done. They cannot show how that candidate will behave when embedded in a fast-moving fintech culture. Behavioural signals fill that gap. Patterns in how individuals problem-solve, respond to ambiguity, or interact with teams often foreshadow their long-term alignment. Psychometric tools and Rec2Tech’s behavioural blueprints capture these signals during the hiring process, creating a profile that benchmarks candidates against proven high performers. Instead of waiting months to see if a hire adapts, fintech leaders can make informed decisions upfront. It is retention by design rather than by chance. Benchmarking Beyond Skills A fintech CTO may know that a new engineer can write flawless code. The more pressing question is whether that engineer thrives in a regulatory sprint, stays motivated under investor scrutiny, and collaborates without friction in a hybrid team. Rec2Tech’s process benchmarks candidates not only for technical competence but also for cultural and behavioural fit. This dual lens helps identify hires who will stay for 12 months and beyond, avoiding the stop-start cycles that plague many scaling firms. By comparing candidates against behavioural blueprints, the process ensures alignment with company values, communication style, and pace of change. The result is a shortlist where every candidate is both capable and committed. The Cost of Mis-Hire in Fintech The financial burden of a mis-hire extends far beyond salary. When a hire exits early, the loss compounds through delayed product launches, overworked colleagues, and leadership distraction. For fintechs raising funds or preparing for expansion, the signal to investors can be damaging. Turnover also erodes morale. Teams that see a revolving door of colleagues begin to doubt leadership decisions and question cultural stability. Retention safeguards more than headcount; it safeguards trust. By embedding behavioural insight in hiring, Rec2Tech helps fintech leaders cut off churn at the source. The goal is not just to fill a vacancy but to ensure that six, nine, and twelve months later, the hire is still contributing at full capacity. Retention Built Into the Hiring Journey Rec2Tech structures the recruitment journey to keep retention front and centre. This systematic approach means retention is never left to chance. Each stage builds on the last, creating a hiring process where behaviour is weighted as heavily as skills. Cultural Alignment as a Retention Driver Technical misfits can be trained. Cultural misfits rarely can. For fintechs operating under regulation and constant investor attention, cultural misalignment is often the fastest route to turnover. By prioritising behavioural fit, fintech leaders can reduce conflict, increase collaboration, and maintain momentum. It is less about hiring people who look the same and more about hiring people who share the same approach to solving high-stakes problems. Culture is the invisible glue that holds high-growth teams together. Behavioural benchmarking makes it visible before the contract is signed. Data-Driven Hiring for High-Growth Fintechs Speed and precision rarely coexist in hiring. Fintech leaders often feel forced to choose between filling a role quickly and taking time to safeguard retention. Rec2Tech bridges this divide with data-driven methodologies that accelerate decision-making without sacrificing alignment. With psychometric insights, hiring managers move beyond gut instinct. Instead of debating whether a candidate “seems right,” they can view behavioural evidence mapped against proven benchmarks. That evidence base speeds up hiring while increasing the probability of a 12-month fit. The Strategic Value of 12-Month Retention For fintech executives, retention is not about avoiding re-recruitment costs alone. It is about positioning the company to grow without distraction. A hire who remains beyond 12 months is a multiplier. Their knowledge compounds, their cultural contribution deepens, and their stability signals strength to clients and investors alike. Rec2Tech: Retention by Design Rec2Tech partners exclusively with fintech startups and scaleups that need speed without sacrificing quality. By embedding behavioural insights into every hire, the firm ensures clients secure not just candidates but committed contributors. Retention by design means fintech firms avoid the hidden costs of churn and instead build high-performance teams ready to deliver across funding rounds, regulatory hurdles, and rapid expansion. With the Rec2Tech hiring process, you gain speed without sacrificing culture fit. Turning Behaviour Into Retention Strategy Retention is the outcome of choices made before day one. By focusing on behavioural signals and benchmarking candidates against proven blueprints, fintech leaders can predict who will thrive for the long term. Rec2Tech’s approach ensures hires are technically capable, culturally aligned, and motivated to stay well past their first year. For fintech executives under pressure to scale, this is the difference between constant firefighting and building teams that compound strength over time. Ready to build fintech teams that stay? Book a call with Rec2Tech today to start hiring with retention in mind.

Fintech Salary Benchmarks 2025: Mid-Year Engineering Update

The first half of 2025 has been anything but predictable for fintech hiring. Engineering salaries, once relatively steady, have jolted upwards and sideways in ways that make last year’s forecasts look outdated. For scale-up founders and talent leaders, this isn’t just another market report — it’s a warning light. Salary expectations are now moving as fast as venture rounds used to. Miss the shifts, and you risk losing engineers to competitors who have already adapted their offers. Let’s look at what’s driving these changes and where fintech engineering pay stands at the mid-year mark. The Big Picture: Salary Bands in Motion If 2024 was defined by budget caution and slower hiring, 2025 has flipped the script. The rebound in venture funding during Q1 triggered a wave of team expansions, particularly in payments, embedded finance, and AI-powered risk tools. With more capital came fresh demand for engineers — and rising salaries to match. Here’s how the average benchmarks look today across the UK fintech market: Contract day rates tell a similar story: senior contractors are now commanding £650–£750/day, with some niche AI/ML engineers touching £900/day when IR35 status is outside. Why Salaries Are Rising Faster Than Expected Three forces are shaping the mid-year surge: Every fintech, whether in lending, compliance, or wealth tech, is scrambling for AI expertise. The result? Salaries for data and machine learning engineers are rising like tide levels after a storm surge. New FCA (Financial Conduct Authority) requirements and tightening European data rules mean that cybersecurity and DevSecOps specialists have become indispensable. Companies aren’t hesitating to pay extra for talent that shields them from fines and reputational damage. After two cautious years, seed and Series A rounds are flowing again. When early-stage firms raise, they need engineers yesterday. That urgency is inflating salary offers, particularly for full-stack and product-facing developers. Regional Hotspots: London, Dublin, and Beyond London remains the centre of fintech pay gravity. Senior engineers in Canary Wharf and Shoreditch are now fielding offers 10–15% above the UK average. Dublin is closing the gap fast, driven by US firms planting European engineering hubs there. Elsewhere, the gap between regional UK salaries and London has narrowed. A mid-level engineer in Manchester, once £10k behind London, now sees only a £4–5k differential. Remote-first hiring is smoothing out regional pay bands, though London perks (equity, hybrid flexibility) still hold sway. The GCC and European Market Pulse Rec2Tech’s clients in the Gulf Cooperation Council (GCC) and mainland Europe are seeing similar dynamics: For scale-ups with cross-border hiring ambitions, benchmarking salaries locally is now mission-critical. What looks like a strong London offer may fall flat against Dubai’s tax-free allure or Berlin’s equity-heavy packages. Equity, Bonuses, and Non-Cash Perks It’s not all about base pay. Candidates are scrutinising equity and retention bonuses more carefully in 2025 than in any previous cycle. Fintechs that ignore these levers risk being outbid, even if their base salary is competitive. Gender Pay Gaps and Inclusion Trends The mid-year data also reveals a less encouraging reality: the gender pay gap in fintech engineering remains at 14% in the UK, slightly improved from last year’s 16%. Progress is happening, but slowly. Companies that invest in structured benchmarking and transparent salary bands are narrowing gaps faster. Those that leave pay decisions to “case-by-case negotiation” continue to lag behind. What Hiring Managers Need to Do Now Salaries are shifting quickly, and waiting for year-end reports risks leaving your offers out of touch. Here’s where fintech leaders should focus in the next six months: Why Rec2Tech Tracks Salary Shifts in Real Time At Rec2Tech, we’ve seen retention dip whenever founders underestimate how fast the market is moving. Our data-driven hiring models don’t just shortlist the right engineers — they also benchmark offers against live market conditions, ensuring placements stick beyond the 12-month mark. With 96% of Rec2Tech placements still in seat after a year, it’s clear that matching compensation to market reality isn’t optional. It’s the difference between building a stable team and fighting endless turnover. A Storm Worth Preparing For Fintech salaries in 2025 are shifting like summer weather over Canary Wharf: hot, humid, and suddenly turbulent. Founders who treat pay as a once-a-year exercise will be caught in the storm. Those who adjust mid-year, bake flexibility into offers, and leverage smarter benchmarking will ride out the volatility with stronger, more loyal teams. At Rec2Tech, our process blends behavioural benchmarking, psychometrics, and data-driven shortlisting to deliver hires that stay. By aligning compensation with market reality and cultural fit, we help fintech scale-ups secure engineers who remain in seat long after day one.If you’d like tailored benchmarks for your engineering team — across London, Europe, or the GCC — Rec2Tech can help. Schedule a strategy call today:

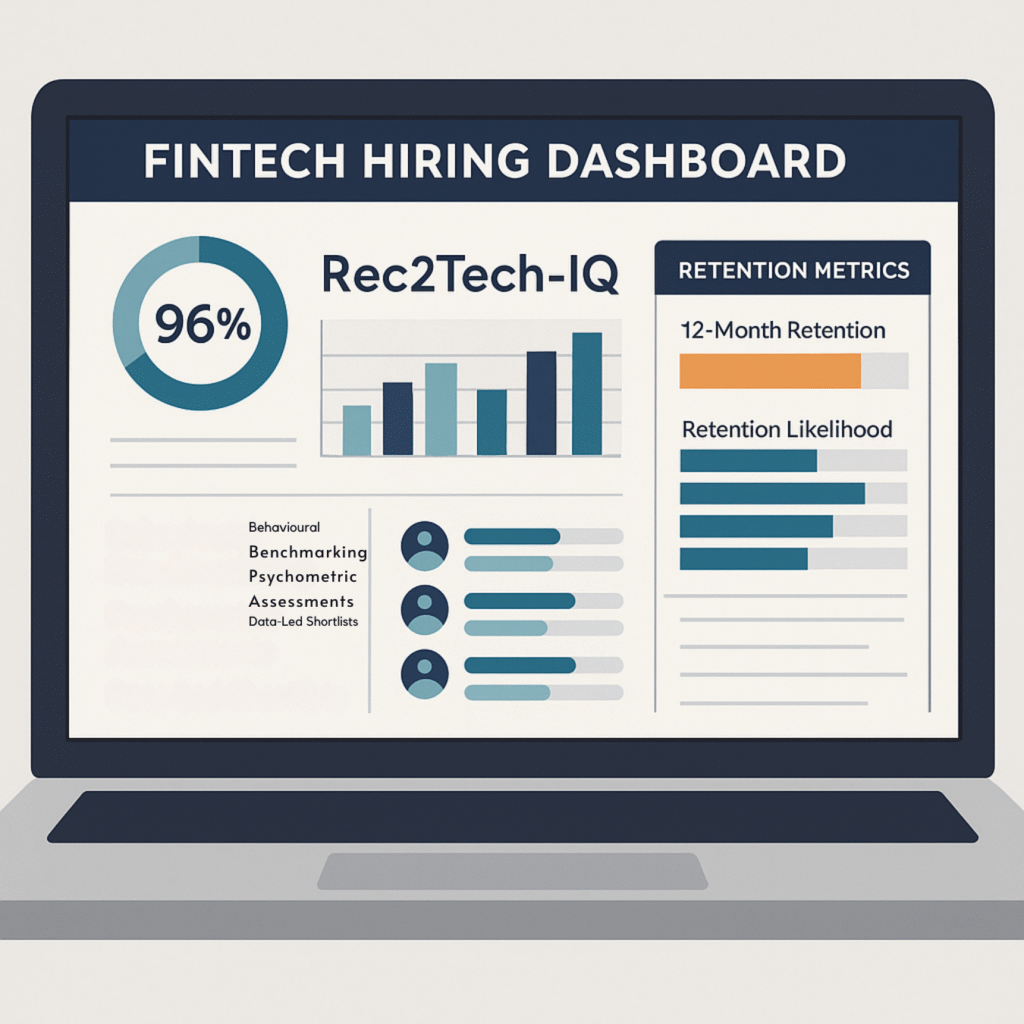

Inside Rec2Tech-IQ: Data-Led Hiring That Delivers 96% Retention

In fast-growth fintech, the pressure to hire quickly can be relentless. Funding rounds accelerate product roadmaps, clients demand new features, and compliance deadlines loom. Amid all that urgency, hiring mistakes are common and costly. Studies show that a single mis-hire at a senior tech level can drain six figures in lost productivity, recruitment fees, and missed opportunities. For startups and scaleups operating with lean teams, the wrong hire doesn’t just slow progress. It can derail entire projects, delay launches, and even shake investor confidence. That’s why retention, not just speed, must be the ultimate measure of hiring success. Rec2Tech-IQ was built on that principle. And it’s the reason 96% of placements are still in their roles 12 months on. What Is Rec2Tech-IQ? Rec2Tech-IQ is the data-driven hiring methodology developed by Rec2Tech for fintech startups and scaleups. It combines three elements that traditional recruitment often treats as separate: The approach doesn’t just identify who can do the job; it identifies who will stay in the job and thrive. Why Traditional Hiring Falls Short in Fintech Many fintech leaders admit that their hiring process is still largely gut-driven. CVs get skimmed, interviews are rushed, and cultural fit is judged on instinct. That can work for low-risk roles, but in a competitive, regulated sector, the stakes are higher. Three common pitfalls cause most hiring failures in the sector: Rec2Tech-IQ addresses these gaps by grounding every stage in data, not assumptions. Step-by-Step: How Rec2Tech-IQ Works 1. Role Assessment & Success Blueprint Before a search begins, Rec2Tech works with hiring managers to define the role beyond the job description. This includes: This blueprint becomes the benchmark for candidate evaluation. 2. Behavioural Benchmarking Using data from psychometric tools and team performance analysis, Rec2Tech builds a behavioural profile for the role. This isn’t guesswork; it’s based on traits and motivators that correlate with retention and high performance in similar fintech environments. 3. Multi-Layer Candidate Assessment Every candidate goes through a multi-stage process: 4. Data-Led Shortlist Delivery Instead of sending over a stack of CVs, Rec2Tech delivers a curated shortlist. Each profile includes a retention likelihood score, behavioural match data, and key motivators so hiring managers can make informed decisions quickly. 5. Post-Hire Engagement Retention doesn’t stop at offer acceptance. Rec2Tech runs structured post-hire check-ins at key intervals: 1 month, 3 months, 6 months, and 12 months. These touchpoints help address potential friction early and keep talent engaged. The Results: 96% Retention After 12 Months The proof of the process is in the numbers. Across placements made since 2022, 96% remain in role a year later. For fintech companies, this translates into: Why Data-Led Hiring Works Better in Fintech Fintech isn’t like other sectors. Its blend of regulatory pressure, rapid innovation, and high-stakes funding means that team misalignment can be fatal. Data-led hiring offers three distinct advantages: The Future of Hiring at Fintech Scaleups The competition for senior tech talent will only intensify. Emerging areas like blockchain, AI-driven risk modelling, and embedded finance are creating roles that didn’t exist five years ago. The ability to hire — and keep — rare talent will be a defining factor in which scaleups succeed. Rec2Tech is already expanding Rec2Tech-IQ with deeper analytics, including: What Founders Can Do Now If you’re leading a fintech startup or scaleup, here are three practical steps to strengthen retention before your next hire: Retention Is a Strategic Metric Too many hiring processes treat “offer accepted” as the finish line. In reality, the true measure of success is where that hire is in 12 months. For fintech leaders under pressure to scale fast without losing quality, data-led hiring is no longer optional; it’s the competitive edge. With Rec2Tech-IQ, Rec2Tech isn’t just filling seats. It’s building high-performing, culturally aligned tech teams that stick. The 96% retention rate isn’t a coincidence; it’s the product of a method designed for the unique challenges of fintech scaling. If you’re ready to reduce turnover, speed up hiring, and strengthen your team’s long-term performance, Rec2Tech can help. Book a call with us today.

The 96% Hiring Blueprint: How to Build a Tech Team That Sticks

Speed powers fintech success, yet rapid growth without loyal engineers drains capital fast. Founders often describe the frustration of training a developer for months only to watch them leave for a bigger offer. In 2024, Rec2Tech achieved a 96 % twelve‑month retention rate across senior placements. The blueprint below shows how, step by step, so you can copy the results. This blueprint condenses a decade of fintech recruitment lessons into a clear, repeatable process any founder can follow. This blueprint is practical: no jargon‑heavy theory, just steps tested across start‑ups handling payments, wealth tech, and open banking APIs. By the end you will have a repeatable process your team can run without outside help. Expect checklists you can paste into your ATS and interview questions ready for your next hiring call. The Hidden Cost of Mis‑Hires Hiring the wrong engineer rarely shows up as a single line item, yet its impact is felt across every sprint board. A study by the Australian Human Resources Institute estimates the total bill for a six‑month mis‑hire at 2.5 times salary. In seed or Series A firms, that figure is often cash earmarked for runway. Why Traditional Hiring Lets Founders Down Traditional pipelines were built when product cycles were measured in quarters, not weekly deployments. Paper skills tell half the story A degree from a leading university signals academic success, yet says little about pair‑programming habits, Git hygiene, or appetite for security reviews. In modern fintech, those traits drive daily value. First‑impression bias Quick judgements tend to favour candidates who mirror the interviewer’s background. The result is a narrow talent pool and groupthink, both enemies of product diversity. Mis‑matched incentives External recruiters earn when a placement starts, regardless of future retention. Internal hiring managers juggle backlog items and aim to close open roles fast. Both forces shorten due diligence and raise churn odds. The Retention‑First Hiring Framework A hiring process focused on retention treats each stage as evidence gathering. Move a candidate forward only when proof supports a long stay. 1. Clarify the Role Progress starts with a sharp role outline. The exercise often cuts ‘nice‑to‑have’ requirements, opening the door for non‑traditional candidates who can still achieve core outcomes. 2. Multi‑Layer Assessment This is the engine room of the blueprint. Layer Aim Example Method Skills Check Confirm technical baseline Pair‑programming on a small live repo Behaviour Review Understand work style under pressure Structured questions tied to past actions Values Match Test culture fit and contribution Scenario session with future colleagues Scores stay separate; a red flag in any column stops the process until clarified. 3. Guard‑Rails After Offer Fintech founders know that even a thorough process carries some doubt. A one‑year replacement promise shifts that risk from the founder to the provider. Pair this with onboarding guard‑rails: Hires feel supported; teams gain a clear picture of progress. CVs Count for Just 10 % Why give the CV a modest slice of influence? Placing too much weight here filters out capable engineers who built skills in bootcamps or open‑source projects rather than large brands. A practical hack: blur candidate names and universities on the first review pass. Many founders are surprised by how often they still shortlist the same people. Removing labels forces attention on code samples, open‑source commits, and problem‑solving explanations. Screening for Behaviour, not Skill Alone Matching values begins with defining them. Supplement interviews with objective tools such as Predictive Index to ground decisions in consistent data. Common Questions from Fintech Founders How long does the whole process take?With disciplined scheduling the three assessment layers fit inside three weeks, including reference checks. Do multi‑layer assessments put candidates off?Clear communication keeps them engaged. Most senior engineers appreciate a chance to show real ability instead of ticking keyword boxes. What if a great coder misses the behaviour mark?Invest in coaching only after clear evidence of a growth mindset. Otherwise keep the door open for a future role but pass for now. Can this work for remote teams?Yes. Pair‑programming, scenario role‑play, and behaviour interviews run well on video when guidelines are set in advance. Does this apply to non‑engineering roles?Yes. Swap the skills check for a task relevant to product, design, or risk, and keep the behaviour and values steps unchanged. Retention numbers follow a similar path. Mini Case Study: Scaling a Payments API A European payments start‑up needed ten platform engineers inside six months. Using this blueprint they filled all roles in five months and kept nine engineers for the next 18 months. The only departure moved abroad for family reasons. Key numbers: Bringing It All Together When every gate looks at retention first, your hiring pipeline becomes self‑correcting. If a candidate scores low on behaviour fit you pause rather than hoping training will fix it. That discipline protects the runway and removes the cycle of ‘hire‑depart‑rehire’. Firms that switch to this blueprint report: Next Steps: Put the 96 % Blueprint into Action Your next engineer should still be shaping features when you plan your Series B. By centering hiring around retention (clear roles, layered checks, and early support), you swap guesswork for evidence. Ready to begin? Book a 20‑minute call with Rec2Tech and build a team you can count on next year.