For fintech startups, Q4 is often when funding rounds collide with ambitious hiring goals. Investors want proof you can scale, but aggressive headcount growth without discipline can drain your runway before fresh capital arrives.

Hiring too fast risks misalignment; hiring too slowly can mean missed market opportunities. The balance is delicate.

At Rec2Tech, we’ve seen how fintech founders in the UK, Europe, and GCC burn through budgets by expanding teams without factoring in retention, onboarding, and real productivity timelines.

Planning your Q4 hires is less about filling chairs and more about showing investors that every hire extends, rather than shortens, your financial runway.

Protecting Your Runway with Smarter Hiring

Expanding headcount is one of the largest and least reversible costs on a fintech’s balance sheet. Payroll can quickly consume 60–70% of monthly burn, which makes hiring decisions as significant as product development or market expansion choices.

Protecting your runway requires founders and finance leaders to think beyond salary budgets and take a more holistic view of people costs.

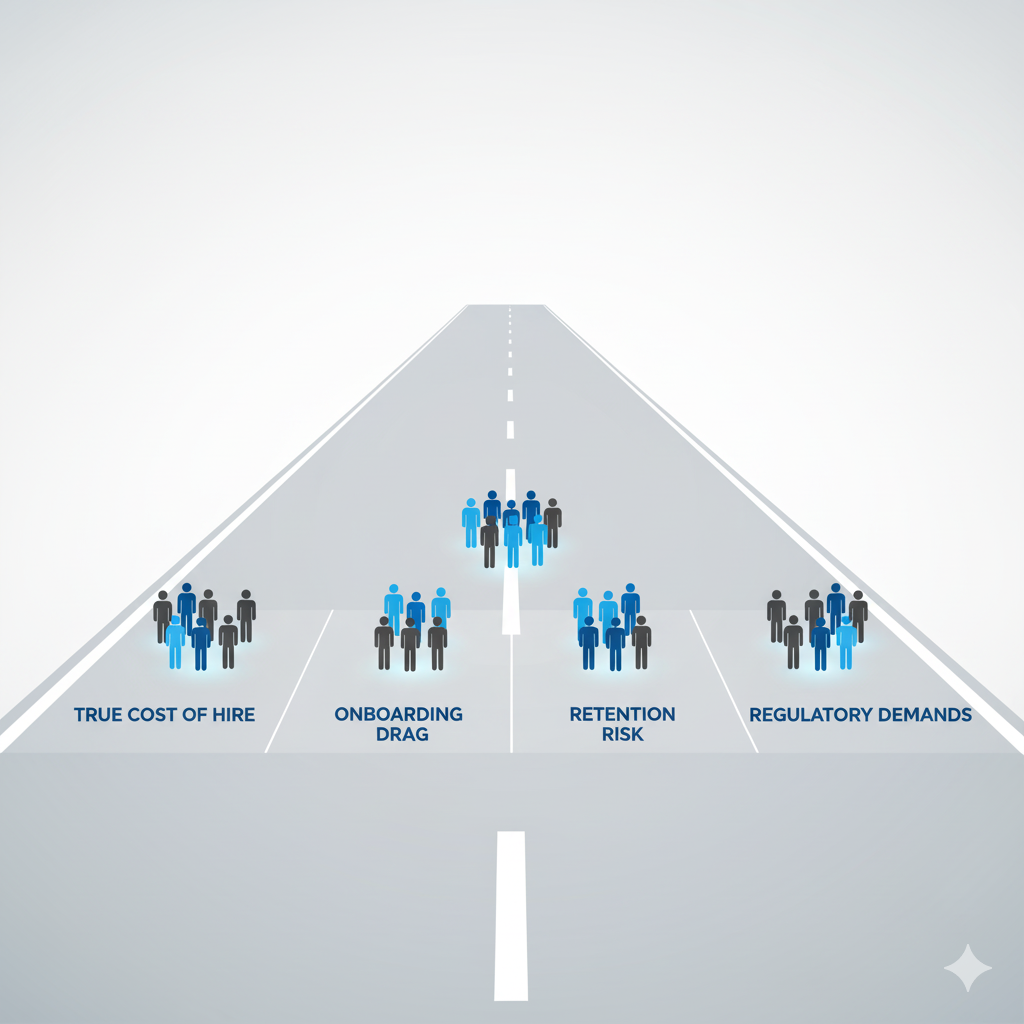

- True cost of hire: Beyond the headline salary, employers must factor in national insurance contributions, pension schemes, benefits, bonuses, and equity packages. Each of these adds to the monthly outflow and impacts how long cash reserves last. A hire who seems affordable on paper can stretch your burn rate once these hidden costs surface.

- Onboarding drag: Even top-tier hires rarely deliver immediate value. It typically takes three to six months for new employees to understand systems, build working relationships, and start delivering results. That lag means startups must plan for a productivity gap while still carrying full payroll costs.

- Retention risk: A mis-hire isn’t just inconvenient; it can cost six figures when you account for lost time, recruiter fees, salary paid during probation, and the opportunity cost of delayed progress. Worse, it can demoralise teams and slow momentum at critical growth points.

- Regulatory demands: For regulated fintechs, some roles cannot be postponed. Compliance-heavy positions such as Chief Information Security Officer (CISO) or Head of Risk have a direct impact on investor confidence and regulatory approval. Delaying these hires risks fines, delays in licensing, or investor pullback.

When you treat headcount planning as you would any other investment case—balancing cost, risk, and return—you send a clear signal to investors: your people strategy safeguards future capital rather than simply consuming it.

Download your FREE Guide: Bad Hire. Big Cost – How To Avoid Hiring Mistakes

Aligning Hiring with Funding Milestones

Investors are rarely impressed by aggressive hiring alone. They want to see that every headcount decision is tied to cash flow discipline and measurable growth outcomes. The most resilient fintechs hire in phases that match their funding stages, rather than hiring all at once.

- Pre-funding hires: These are the essential roles required to keep operations running and show momentum. Think CTOs to lead architecture, compliance specialists to satisfy regulators, or senior engineers to keep product development on track. These hires demonstrate capability and keep the lights on without draining too much capital before the next round closes.

- Post-funding hires: Once capital is secured, the priority shifts to scaling. Product squads, data science teams, and customer success units become vital. These roles directly support revenue generation, platform robustness, and customer retention, making them easier to justify to investors reviewing post-round allocation.

- Deferred hires: Some positions can safely wait until Series B or later, particularly in marketing scale-ups, international expansion teams, or administrative support. By deferring these hires, startups preserve runway and show investors that growth ambitions are tempered with financial discipline.

This phased approach signals to investors that you’re building with intent, not just speed. It strengthens your funding deck by making hiring decisions look like strategic moves rather than reactive spending.

The Investor’s Perspective

For investors, your hiring plan is a litmus test of operational maturity. A product roadmap can excite, but a headcount strategy reveals whether you can manage capital responsibly. Before writing a cheque, investors will ask:

- Will this team survive to Series B? Investors want to know if the people you hire now will still be in place through the next funding cycle, avoiding disruption when stability is most critical.

- What retention mechanisms exist? High turnover raises red flags. Investors look for evidence that you’re using behavioural benchmarking, cultural alignment, or incentive structures to keep key hires beyond the funding round.

[ - Are hires justified by revenue progress? Over-investing in expensive senior hires before proving revenue traction suggests mismanagement. Investors want to see sequencing—proof you’ve earned the right to scale.

- Can your current runway sustain the plan? If your headcount model burns through cash too quickly, you may need a bridge round. That’s a sign of weakness, not strength, in the eyes of investors.

Answering these questions clearly shows that you’re not just chasing growth, but building a sustainable business. It separates startups that burn cash from those that attract confident backers willing to fund long-term success.

Good Read: How a 12-Month Free Replacement Promise Protects Your Runway

How Rec2Tech Supports Funding-Linked Hiring

Rec2Tech partners with fintech startups and scaleups to create hiring strategies that protect runway while supporting growth. Unlike agencies that simply fill roles, we align every hire with your funding cycle and investor expectations. Our support spans:

- Retention modelling: Using behavioural insights and psychometric benchmarks, we ensure new hires are not just technically capable but also likely to stay through critical growth milestones. This reduces churn and strengthens investor confidence in team stability.

- Vacancy heatmaps: We help founders see which roles are critical now, which can wait, and which may be replaced by automation or outsourcing. This prioritisation avoids over-hiring and makes your hiring plan more credible to investors.

- Funding-aligned hiring roadmaps: We design phased headcount strategies that balance cash burn with operational needs, stretching runway while showing fiscal discipline. These roadmaps often become powerful slides in funding decks, giving investors confidence in both financial stewardship and growth potential.

- Post-hire support: Our involvement doesn’t end with placement. We provide ongoing retention checks during the first 12 months, offering founders early warning signals on flight risk and helping teams adapt to new hires effectively.

This approach prevents the “panic hire” spiral—where startups overpay for quick fixes that inflate payroll without delivering long-term value. Instead, it ensures every hire strengthens your growth story while keeping your financial runway intact.

Headcount Planning as a Funding Signal

In Q4, every pound matters. Investors don’t want to fund runaway hiring; they want to fund controlled growth. By showing discipline in headcount planning, you protect your runway, impress your investors, and build teams that scale with stability.

Rec2Tech helps fintech founders create people strategies that investors trust. If you’re heading into a funding round, we’ll help you design a hiring plan that keeps your growth ambitions intact without burning through your cash.

Book a strategy call today with us.